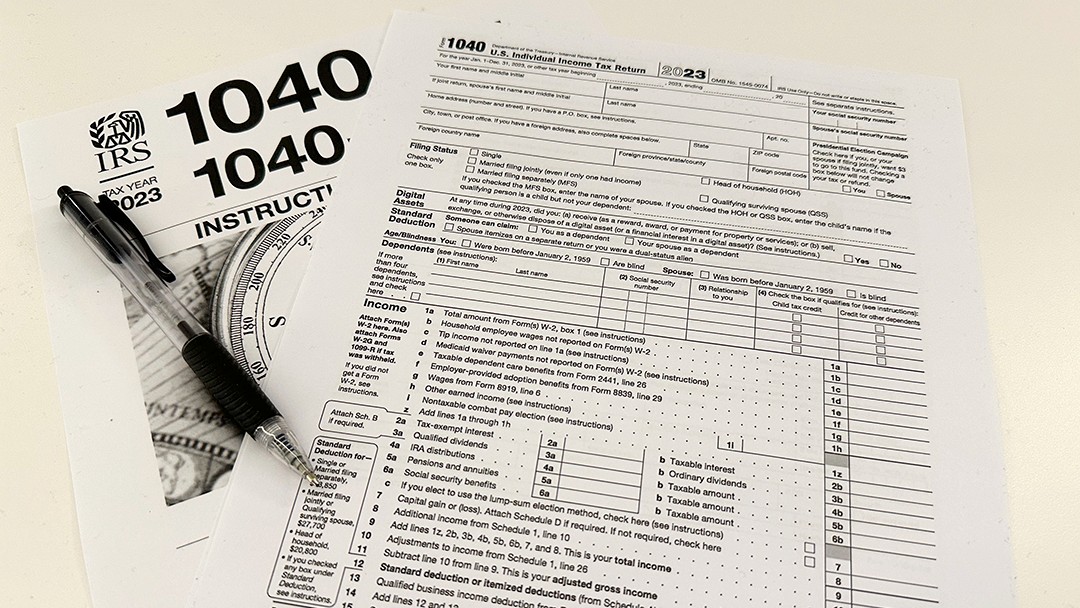

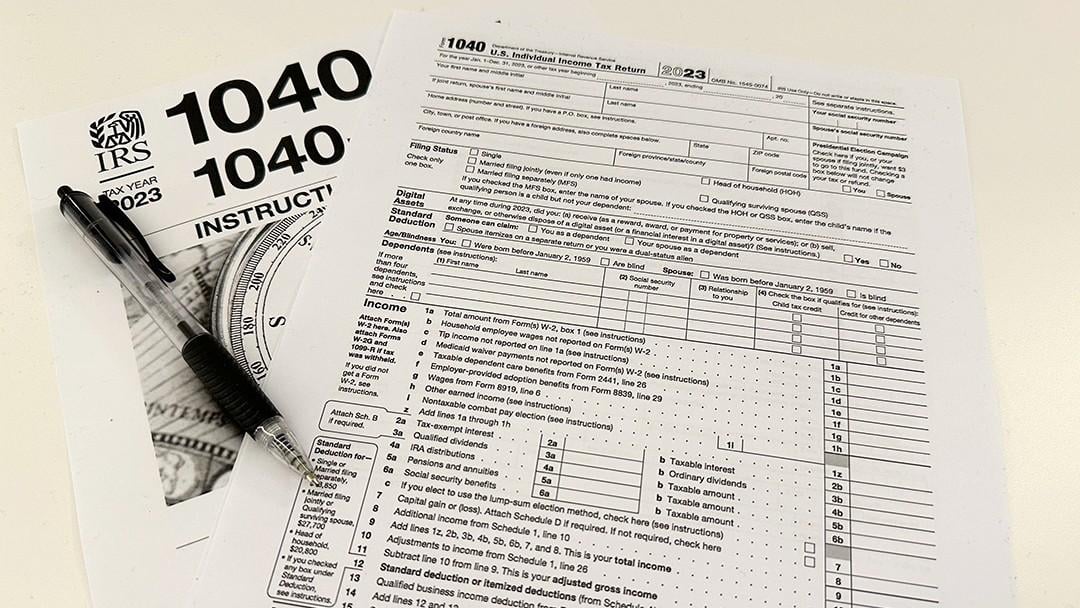

2024 Irs Schedule 30 Instructions – Estimated Federal Tax Refund Schedule Filing Method E-File The IRS may send you instructions through the mail if it needs additional information in order to process your return. . Robert Wood Tax is an attorney at WoodLLP. He is also the author of more than 30 books and numerous articles which is reported on line 8 of Schedule 1. There’s no perfect solution, but .

2024 Irs Schedule 30 Instructions

Source : www.irs.govTax Season is Under Way. Here Are Some Tips to Navigate It

Source : news.wttw.comInstructions for Forms 1099 INT and 1099 OID (Rev. January 2024)

Source : www.irs.govTax Season is Under Way. Here Are Some Tips to Navigate It

Source : news.wttw.com1040 (2023) | Internal Revenue Service

Source : www.irs.govTax season is under way. Here are some tips to navigate it. | News

Source : www.nashuatelegraph.com1040 (2023) | Internal Revenue Service

Source : www.irs.govGreen Dot Bank® on X: “Ready to file your refund? Get your tax

Source : twitter.comForm 8843 Filing Instructions How to fill out 8843 form online

Source : blog.sprintax.comIRS now accepting your 2023 tax returns

Source : www.usatoday.com2024 Irs Schedule 30 Instructions 1040 (2023) | Internal Revenue Service: There’s a 30%-of-AGI limit for capital gain property are generally limited to five years). Check the Schedule A instructions and IRS Publication 526 for details and additional limits. . The income and expenses must therefore be recorded on Schedule IRS requires nonresidents of the U.S. to report gambling winnings on Form 1040NR. Such income is generally taxed at a flat rate .

]]>

More Stories

Free Art Basel Events 2024 Schedule

Pot Of Gold Festival 2024 Dates

Winter Recess 2024 Nyc Doe