Business Meals And Entertainment 2024 Tax – For 2024, the estate and gift tax exemption is $13,610,000 per person. That means any one person can give during their lifetime or at their death a total of $13,610,000 without incurring gift or . Day-to-day, he oversees the operations and programs of the association, which represents Garden State developers, owners and other professionals in office, industrial and mixed-use real estate through .

Business Meals And Entertainment 2024 Tax

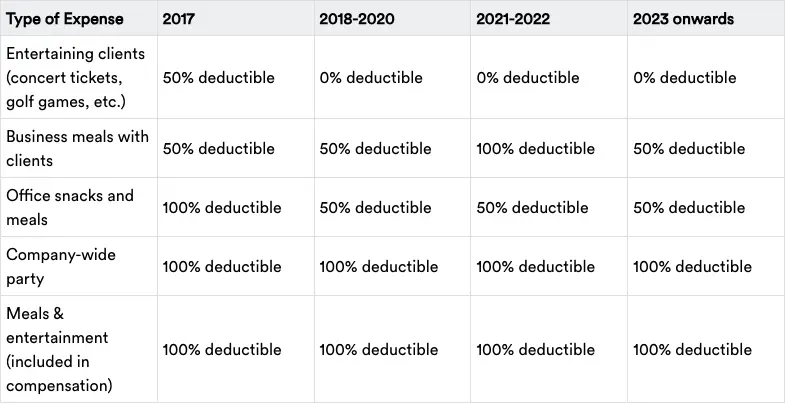

Source : ledgergurus.comHow to Deduct Meals and Entertainment in 2024

Source : www.bench.coMeal and Entertainment Deductions for 2023 2024

Source : ledgergurus.com25 Small Business Tax Deductions To Know in 2024

Source : www.freshbooks.comMeals and Entertainment Deductions In 2024 | The Ray Group

Source : theraygroup.usLower Your Taxes BIG TIME! 2023 2024: Small Business Wealth

Source : www.amazon.aeOfficeOps | New Orleans LA

Source : www.facebook.comBusiness Meals and Entertainment Expenses: What’s deductable?

Source : financialsolutionadvisors.comCB Accounting | Ada MI

Source : zh-cn.facebook.comQuicken on Mac isn’t showing any Business categories — Quicken

Source : community.quicken.comBusiness Meals And Entertainment 2024 Tax Meal and Entertainment Deductions for 2023 2024: Tax filers in Maine and Massachusetts, however, have until April 17 to file and pay, due to those states’ holiday observance of Patriots’ Day and Emancipation Day. If you live or do business in a . In addition to the Top 10, these meet the men and women, listed alphabetically, are the ones creating New Jersey’s future. .

]]>

More Stories

Free Art Basel Events 2024 Schedule

Winter Recess 2024 Nyc Doe

Nail Designs Spring 2024